A Word About Stimulus Checks

Are you eligible for a stimulus check from the Treasury Department?

As of Friday, April 24, the Internal Revenue Service (IRS) said it had issued 88 million payments to individuals across the country. It plans to send out more than 150 million payments as part of the overall Economic Impact Payments program.1

Here are some of the frequently asked questions (FAQ) many people are asking. Keep in mind, this FAQ is for informational purposes only. It is not a replacement for real-life advice, so make sure you consult your financial planner or tax professional before modifying your strategy.

Who gets a check?

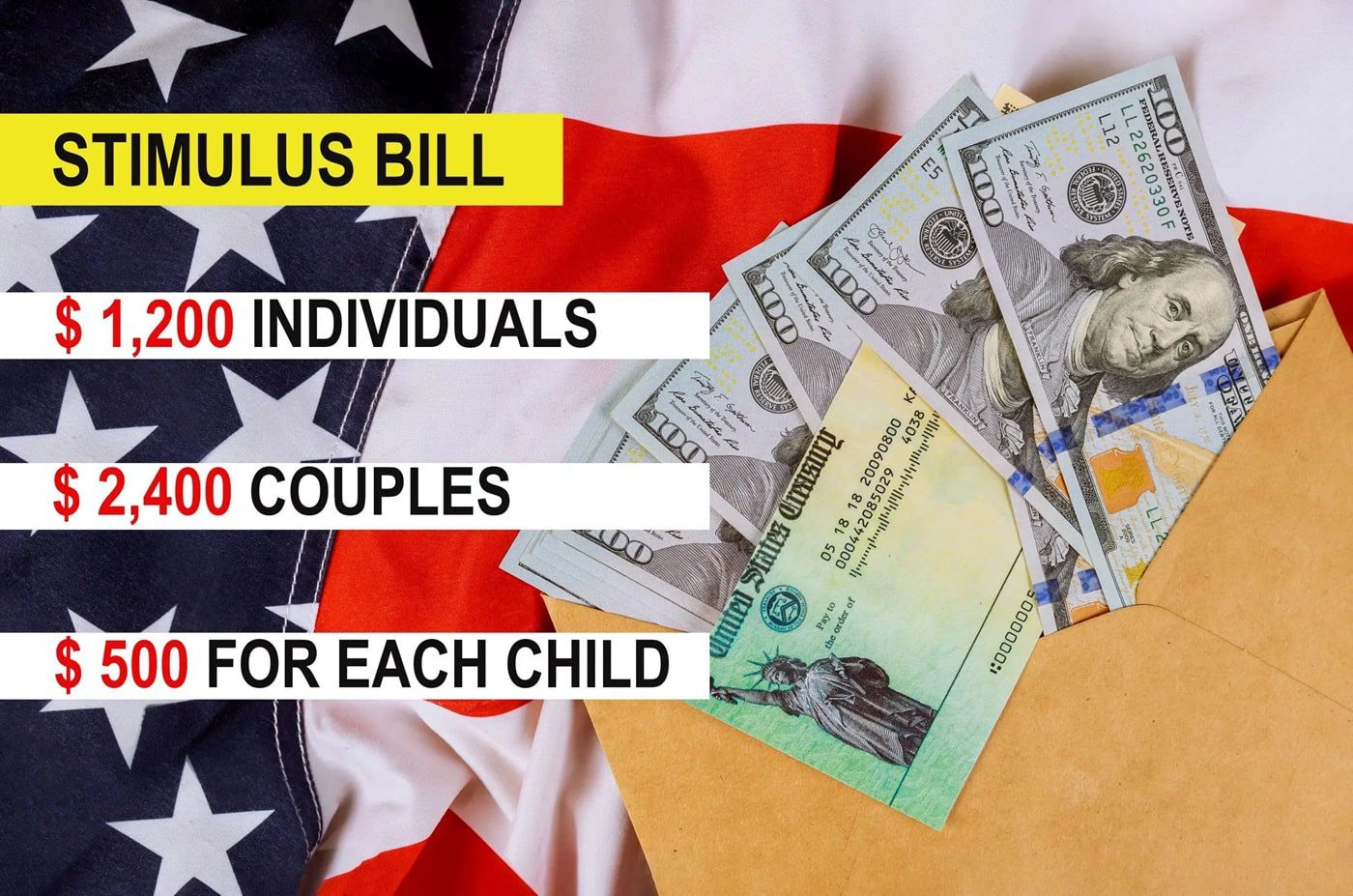

If you have a Social Security Number and have not been claimed as a dependent on another taxpayer’s most recent federal tax return, you may be eligible for a stimulus payment of up to $1,200. Any money you get is tax-free and will not count against a federal tax refund coming your way, or federal benefits you currently receive.2

Can I get a direct deposit, rather than a paper check?

Yes, assuming you provided a bank account number to the IRS when you last filed federal taxes. If you did, the IRS could route the stimulus payment right into that bank account. Another option is to update your account information through the IRS website. Absent such information, the IRS will mail you a check instead.2

When will my payment arrive?

Secretary of the Treasury Steven Mnuchin expects that most eligible taxpayers will receive their stimulus money in April. Taxpayers waiting for a check in the mail may get their payments later.3

Where can I track my payment?

Visit irs.gov/coronavirus/get-my-payment to check your payment status.4

Will most eligible taxpayers receive the full $1,200 payment?

Yes. The payment amount is calculated using your adjusted gross income (AGI) from your most recently filed federal tax return. A qualifying single-filer with AGI of $75,000 or less will get the full $1,200. The same goes for someone filing as a head of household who has an AGI of $112,500 or less.3,5

Joint filers (i.e., married couples) with an AGI of $150,000 or less will get a total of $2,400. Joint filers and heads of households who have kids may get more – specifically, an additional $500 for every qualifying child younger than 17. (A married couple or head of household with three young children could receive nearly $4,000.)3,5

Single filers with AGI of more than $99,000, childless heads of household with AGI of more than $136,500, and childless joint filers with AGI above $198,000 will not receive stimulus checks.3,5

Single filers with 2019 gross income of $12,200 or less and joint filers with 2019 gross income of $24,400 or less must visit irs.gov/coronavirus/non-filers-enter-payment-info-here to facilitate their payments. This also applies to taxpayers who have not yet filed a 1040 form for the 2019 tax year, or have no plans to do so.3,5

Do you have to repay the money later?

No. The stimulus payment is not a loan to you from the federal government. Misinformation about this is circulating, and it may stem from the way the stimulus checks are defined. Technically speaking, the stimulus money is a 2020 federal tax credit. The IRS is effectively giving an advance tax refund to eligible taxpayers.6,7

Does this stimulus payment count against your 2020 taxes?

No. It impacts neither federal tax refunds nor federal tax liabilities.7

If you have any follow-up questions or want to discuss any part of the federal stimulus program, please contact us. We can be reached at (973) 740-2400 or [email protected]. We look forward to speaking with you.

- IRS.gov, April 27, 2020

- BusinessInsider.com, April 22, 2020

- NYTimes.com, April 16, 2020

- IRS.gov, April 21, 2020

- TheBalance.com, April 10, 2020

- IRS.gov, April 22, 2020

- MarketWatch, April 21, 2020