Tax Planning

Archive for the ‘Tax Planning’ Category

Reminder: Second Quarter Estimated Tax Payments Due June 16

If you make estimated tax payments, your next deadline is Monday, June 16. Here's what you need to know.

One Day Left! Tax Contributions Due by April 15 — Unless You File an Extension

Here's what's due by April 15, and what might be eligible for an extension.

Retirement Plan Contribution Deadlines

Retirement plan contribution deadlines can vary. Here's what you need to know as the deadlines approach.

Did You Make a Qualified Charitable Distribution in 2022?

How you report your charitable distributions matters. If you made a QCD from your IRA in 2021, keep reading.

NJ Property Tax Update

Learn how some taxpayers can offset local property taxes using NJ's new ANCHOR program.

Watch Out For These Common Tax Scams

There's no shortage of financial scams throughout the year, and tax season always brings new ones. Watch out for these.

Federal Tax Filing Season Has Started

The IRS is now accepting and processing 2021 tax-year returns. Here are some tips for making your tax filing easier.

2021 Year-End Tax Planning Tips

Year-end tax planning may look different this year, pending new tax laws. Here are some strategies to consider.

Year-End Capital Gain Distributions

Mutual funds must make regular capital gain distributions to shareholders. Here's what to expect for tax planning.

Key Tax Numbers for 2022

Here are key tax numbers for 2022 to help you with your tax planning for next year.

Tax Rules for Rental Income

Real estate can be a great investment. But there are tax rules for rental income to be aware of.

Year-Round Tax Planning Suggestions

With more tax law changes on the way, consider these questions to get ahead in your tax planning.

Debate Starts Over Capital Gains Tax

Capital gains tax proposals typically face long, uphill battles before becoming law. Don't be rattled by the current debate.

The 2021 Tax Filing Deadline Has Been Extended

The 2021 tax filing deadline has been extended. But not for everybody. Here's what you need to know.

American Rescue Plan Act of 2021

Find out what the third stimulus bill is providing (stimulus checks, expanded unemployment benefits, and more).

Second Stimulus Package Update

The second stimulus package includes a spending bill for 2021 and stimulus checks for individuals. Here's what you should know.

Required Minimum Distribution (RMD) Rules Have Changed for 2020

The rules for 2020 Required Minimum Distributions has (temporarily) changed. Don't take your RMD until you read this.

NJ Property Tax Relief Program Updates

You may be eligible to receive property tax relief from the State of NJ. Here's what you need to know.

Important Updates to the Senior Freeze (Property Tax Reimbursement Program)

There's some positive tax news for seniors this year! The 2019 Senior Freeze Program will be fully funded. Learn more.

Tax Alert: NJ/NY Estimated Tax Payments Due Monday

On March 21, the Treasury Department directed the IRS to postpone the tax filing deadline from April 15 to July 15. Included in the extension was the filing of taxes for individuals, corporations, and trusts. First and second quarter estimated tax payments (due April 15 and June 15 respectively) were also extended to July 15. […]

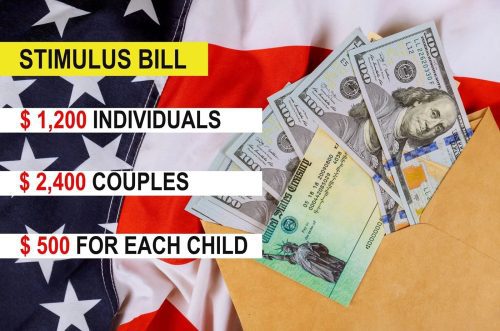

A Word About Stimulus Checks

A Word About Stimulus Checks Are you eligible for a stimulus check from the Treasury Department? As of Friday, April 24, the Internal Revenue Service (IRS) said it had issued 88 million payments to individuals across the country. It plans to send out more than 150 million payments as part of the overall Economic Impact […]

New Jersey Extends Tax Filing and Payment Deadlines

New Jersey has extended the State income tax filing deadline and the corporate business tax filing deadline from April 15 to July 15, due to the COVID-19 pandemic. The extension is automatic. You do not need to file for an extension. Taxpayers can also defer federal income payments due on April 15 to July 15, […]

The CARES Act and You

On Friday, March 28, President Trump signed the CARES Act into law. The CARES Act is an economic stimulus package designed to help small businesses and individuals during these trying times. As COVID-19 has forced people to file for unemployment and thousands of small businesses to cease or curtail operations to prevent the spread of […]

New York State Extends Tax Filing and Payment Deadlines

New York State has extended the April 15, 2020 due date for filing personal income tax and corporate tax returns. This extension applies to returns for individuals, fiduciaries (estate and trusts), and corporations. In addition, taxpayers may defer all related tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, […]

Federal Filing Date Extended (Tax Alert Update)

On Saturday March 21, the Treasury Department and IRS extended the due date for filing Federal income tax returns for ALL taxpayers. The new due date is July 15, 2020. Previously, only the payment date had been extended. Here is a link to the IRS news release: IRS News Release. Please note that as of […]

IRS Provides Some Tax Relief

On March 18, the Internal Revenue Service issued Notice 2020-17, Relief for Taxpayers Affected by Ongoing Coronavirus Disease 2019 Pandemic, which provides relief from penalty and interest for individual taxpayers affected by the COVID-19 emergency. The Notice defines affected taxpayers as “any person with a Federal income tax payment due April 15, 2020.” For those […]

The Facts About Income Tax

Millions faithfully file their 1040 forms each April. But some things about federal income taxes may surprise you. The tax code is so complex that, if tax compliance were an industry, it would employ more than three million full-time workers. Taxes can have a big impact on your finances. Take a quick look at the […]

Year-End Tax Planning Tips for 2019

The Tax Cuts and Jobs Act of 2017 (TCJA) made significant changes to practically everyone’s Federal income taxes beginning in 2018. While there was no significant new legislation in 2019 affecting individual taxes, personal situations do change from year to year, thus requiring a fresh look at how to approach your year-end tax planning. The […]

Tax Bill Update (The SECURE Act)

In December 2018, there was a new tax bill working its way through Congress. Called the “Retirement Savings and Other Tax Relief Act of 2018,” it did not make its way through all of Congress before December 31, when the new Congress took over. A second attempt was made, and on April 2, 2019, the […]

Three Changes to Retirement Accounts You Should be Aware Of

Lost in all the tax law changes that went into effect this year were several changes made to IRA and Roth IRA accounts that bear mentioning. IRS Blessing of the Backdoor Roth IRA The amount of money you can contribute to a Roth IRA is typically limited and direct contributions are completely disallowed if you […]

Tax Bill Alert

Don’t look now but another tax bill is working its way through the House Ways and Means Committee. If passed in its present form, it makes additional changes to retirement plans (among other things), including IRAs and 401(k) plans. The bill also includes technical corrections to the Tax Cuts and Jobs Act of 2018 law, […]

The IRS Tax Withholding Tables May be Inaccurate. Here’s What You Need to Know.

Typically, when a tax law is passed that changes the marginal tax rates, the IRS issues new tax withholding tables (for payroll and pensions) to reflect these changes. The logic behind doing this is simple. Rather than waiting to see the change at the end of the year when you file your taxes, Congress wants […]

Charitable Giving Under the New Tax Laws

I’ve been having more conversations lately with clients about charitable giving. While I have found many to be very generous in their charitable giving, the uptick in conversation is likely due, at least in part, to an overriding concern about a lack of civility in the world. Yet, while specific giving opportunities have arisen recently […]

Webinar Looks at Impact of New Tax Law

The biggest tax overhaul in more than 30 years will have a long-lasting impact on American families, changing the way we prepare our taxes and plan our finances. But how will the law affect you and your family? Howard Hook, who writes and lectures frequently on personal finance issues, recently hosted a free webinar on […]

Stay Up To Date

© 2025 Access Wealth. All Rights Reserved.