Have you ever heard the saying “Slow and steady wins the race?” When it comes to investing and building your nest egg, there is no better advice. Everyone loves to win big, but typically if you can win big, you can likely lose big too, at least when it comes to investments. Most people are willing to give up some of the upsides if they can limit the downside, especially as they get older. But how does one accomplish this? The answer is Asset Allocation.

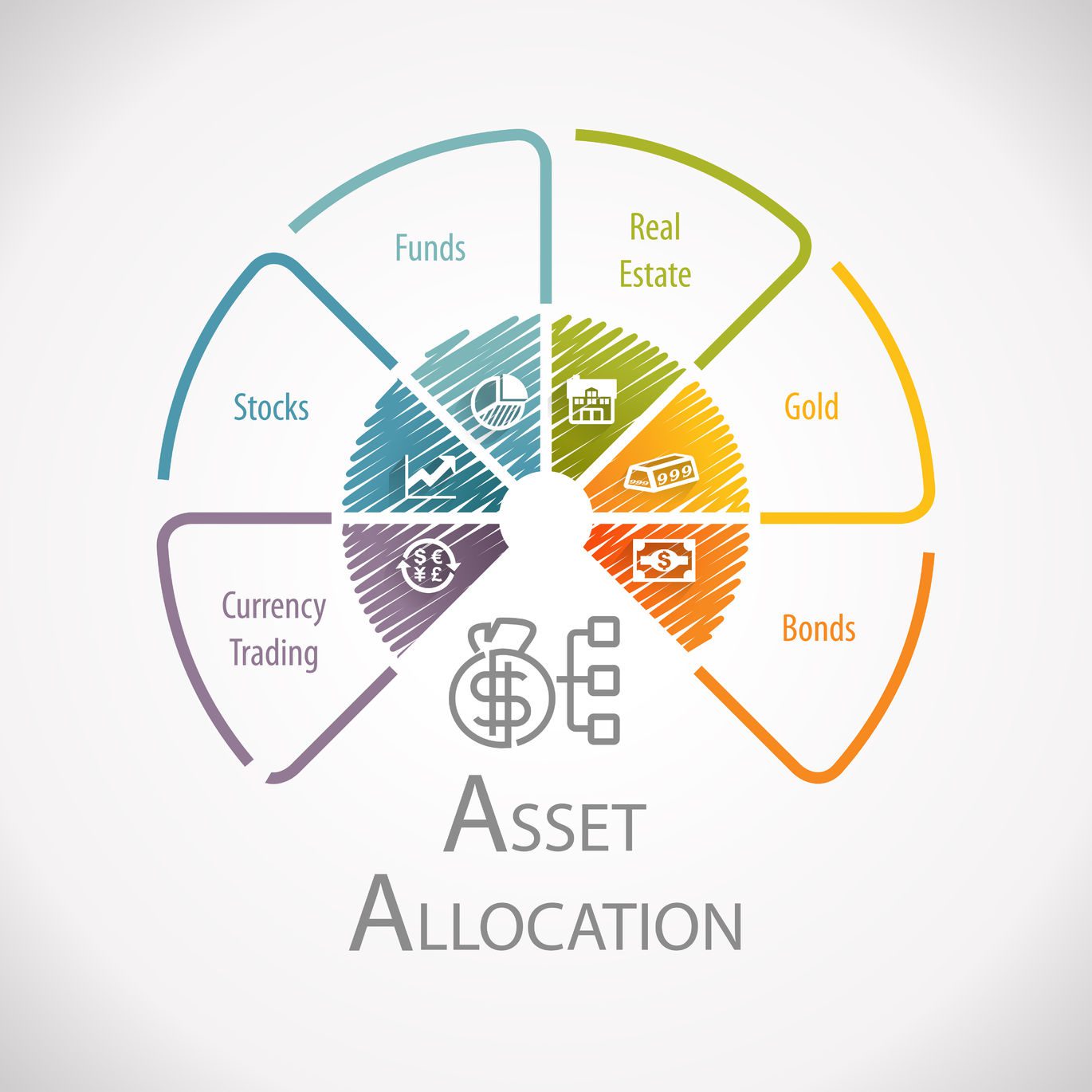

Asset Allocation is an investment strategy that invests in different asset classes – such as stocks, bonds, and cash – to build a portfolio that balances risk and reward based on an investor’s risk tolerance, time horizon, goals and objectives. This investment strategy has been around for decades, is time tested and a proven long-term investment strategy.

As with any investment strategy, there are times when it works beautifully and times when it doesn’t. The key is to understand that over the short-term it may appear the strategy is not working, but if you stay the course and not abandon the investment strategy, then over the long-term your patience is rewarded. Let’s take a deeper look at the advantages and disadvantages of Asset Allocation.

Why Asset Allocation Works

The concept of Asset Allocation is to invest in different asset classes; thus you are diversifying your portfolio and avoiding the dreaded mistake of “putting all your eggs in one basket.” This concept further helps by lowering the overall risk (standard deviation) of the portfolio since typically all asset classes act differently in similar markets. In plain English: everything in the portfolio does not go up together, and everything does not go down together. Over the longer term, this should provide you with more downside protection than keeping your portfolio in one asset class.

If you stay true to this investment strategy, it also offers discipline – which all the research shows is probably one of the most important aspects of the investment strategy. We know that all asset classes will not achieve the same rate of return. Therefore if your portfolio is invested in several asset classes, this allows us to apply my favorite investment saying of all time, “Buy low and sell high.” If an asset class outperforms the others, then we sell the gains in that asset class that outperformed and buy the other asset classes that have underperformed. History shows us that no asset class stays on top and no asset class stays on the bottom forever; therefore, if we can buy more of an asset class that is undervalued (knowing that it will eventually turn around), that gives us better long-term returns.

Unfortunately, sometimes it can take several years to work effectively, so patience is the key. Lastly, having a well-allocated asset portfolio helps prevent market timing since your portfolio is better protected on the downside. Research shows that no one can time the market consistently and trying to time it is detrimental to your long-term returns.

The Trade-Off

Everything sounds good? Sign me up! Before we do that, remember that since the strategy buys several different asset classes and they can act differently, it does potentially limit your upside. This strategy is not designed to hit “Home Runs;” it is designed to hit singles and doubles. There will be times when one or two asset classes do extremely well, and other asset classes do not, causing the portfolio to lag. When this happens, it is easy to see why an investor would pose questions such as: Why is my return lagging? Why don’t we have all the money in the asset classes that are going up? Why do I have bonds or cash in my portfolio? When that happens, I remind clients why we are asset allocated in the first place – think 2008!

Let’s Consider an Example

Take a look at the two portfolios below. If you invested $500,000 which portfolio do you want?

| Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | |

| Portfolio A | 20% | 40% | -30% | 25% | -15% |

| Portfolio B | 6% | 6% | 6% | 6% | 6% |

Which portfolio did you choose?

Portfolio A appears more exciting, surely generating some “water cooler” stories. Its total value at the end of 5 years is $624,750. Portfolio B is boring, and you won’t be able to share any incredible stories with your friends. However, Portfolio B’s total value at the end of 5 years is $669,113. That is a $44,263 or 8.9% difference!

Fighting Human Nature

Human nature typically forces us to question strategies that aren’t working, but the key, of course, is not to deviate from a time-tested, long-term investment strategy. Fighting our conflicting behavior can sometimes be the hardest thing, especially with the Media sensationalizing market ups and downs. Don’t lose faith – take a deep breath and remember, slow and steady wins the race!